The accounts payable process begins when the invoice is received by the AP department. Invoices can arrive through many different methods, including electronically through email, fax, snail mail, inter-office deliveries, or maybe a colleague dropping paperwork in an inbox or on AP clerk desk. When AP processes are not centralized, handling and processing each new invoice is essentially an ad hoc adventure.

Microsoft Dynamics 365 for Finance and Operations now enables “last mile” automation out of the box with an ability to import and store invoice images in vendor invoice source document.

You can now use the third-party optical character recognition (OCR) service provider to scan and seamlessly integrate with Microsoft dynamics 365 for finance and operation to automatically create vendor invoice with the side-by-side attachment viewer functionality.

This blog focuses on the three key components of Vendor invoice automation solution,

- Data entities and data package

- Side-by side attachment viewer

- Exception handling for invoices.

Data Entities and Data Package

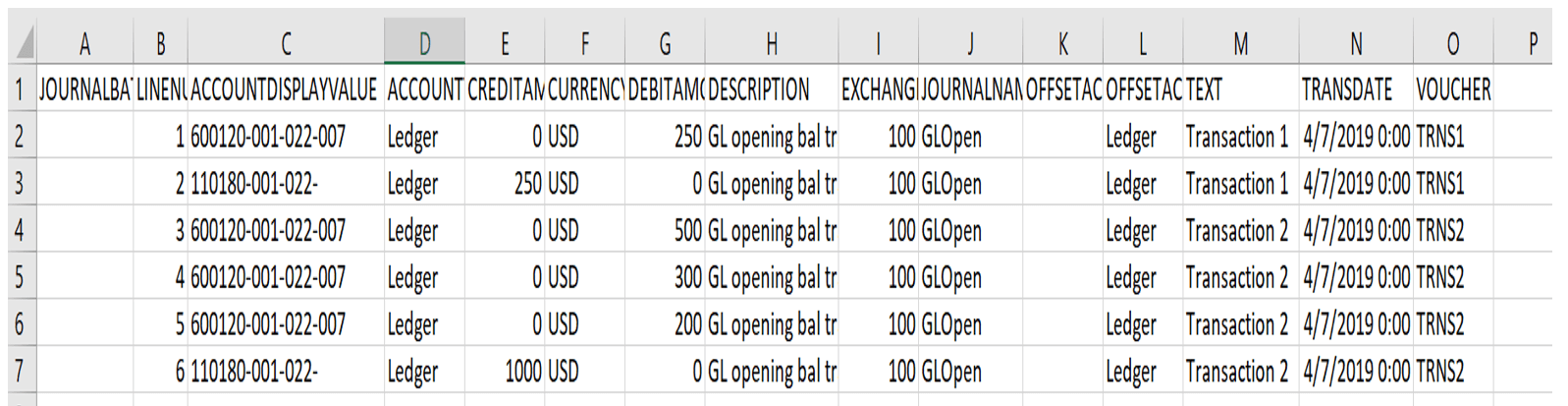

Data entities and data packages are part of Data management framework (Please click here to know more about DMF). What is important for vendor invoice automation is to create and use the data package which consists of header, lines and invoice attachments data entities.

Vendor Invoice document attachment is a new data entity introduced as part of this feature. Vendor invoice header entity has been enhanced to support document attachment functionality.

Now let’s look at the example of how this feature works.

- Create a sample pending vendor invoice with attachment

- Then go to System administration > Data management work space

- Create and export project which consists of Vendor invoice header, Vendor invoice lines and Vendor invoice document attachment entity

- Export the data and download the package.

Export files will be used as a template for the import process, this helps to get all the relevant fields and ensures the correct format.

For vendor invoice header and vendor invoice line fill in the required data for upload process. Please note header reference is unique id to link the Invoice line and document attachment entity to invoice header.

Please see below for the important fields to be considered for Vendor Invoice document attachment entity during the import process,

| SI No | Field Name | Description | Values(Sample) |

| 1 | DocumentID | The GUID generated from the source system for the document | {DEAEA25B-61A9-45B5-8C85-7778BFF1FA40} |

| 2 | DefaultAttachment | To display the attachment side by side in the vendor invoice form. | Yes |

| 3 | FileName | Name of the file without extension | InvoiceSample3 |

| 4 | FileType | Specify the file extension | png |

| 5 | HeaderReference | Header reference is a unique id which links the invoice document attachment to the invoice header | 014597 |

| 7 | TypeID | Specify the type of attachment (E.g.: File, Image, Note, URL) | Image |

| 8 | FileContentsFileName | Full name of the file with extension | InvoiceSample3.png |

Now it’s important to understand where the Invoice image or the Invoice file to be placed. From the export package you would notice the folder Resources > Vendor Invoice document attachment. Similarly create one for import process.

Please note that the import file structure should be same as export structure, select all the import files and compress into zip file,

**The zipped import file will be generally provided by the source system or through the OCR service to Dynamics 365 for finance and operations**

System administration > Data management work space

Create an import project and from the Enhanced view, click on Add file

- Select source data format as ‘Package’

- Click on upload and add, select the zipped file contains the import data

- Note the entities gets added automatically and then follow the normal import process.

Side-by side attachment viewer

Once the invoice is loaded through the data management, the invoice image can be viewed from the pending vendor invoice page side by side for easy reference, this will help the Accounts payable personnel to verify and process the invoice quickly.

Here is the main functionality that the attachment viewer provides:

- View all attachment types that Document management supports (files, images, URLs, and notes).

- View multi-page TIFF files.

- Perform the following actions on image files:

- Highlight parts of the image.

- Block parts of the image.

- Add annotations to the image.

- Zoom in and out on the image.

- Pan the image.

- Undo and redo actions.

- Fit the image to size.

Exception handling for invoices

There could be many scenario’s when scanned invoice from the OCR fails to load into Dynamics 365 for finance and operation. New list page has been added with user friendly option targeting the functional users. This will help to handle the exception and ease the process to rectify the errors and create pending vendor invoice by an Accounts payable personnel himself.

Accounts payable > Invoices > Import failures > Vendor invoices that failed to import.

This page shows all the error records from vendor invoice header from the staging table of the Vendor invoice header data entity.

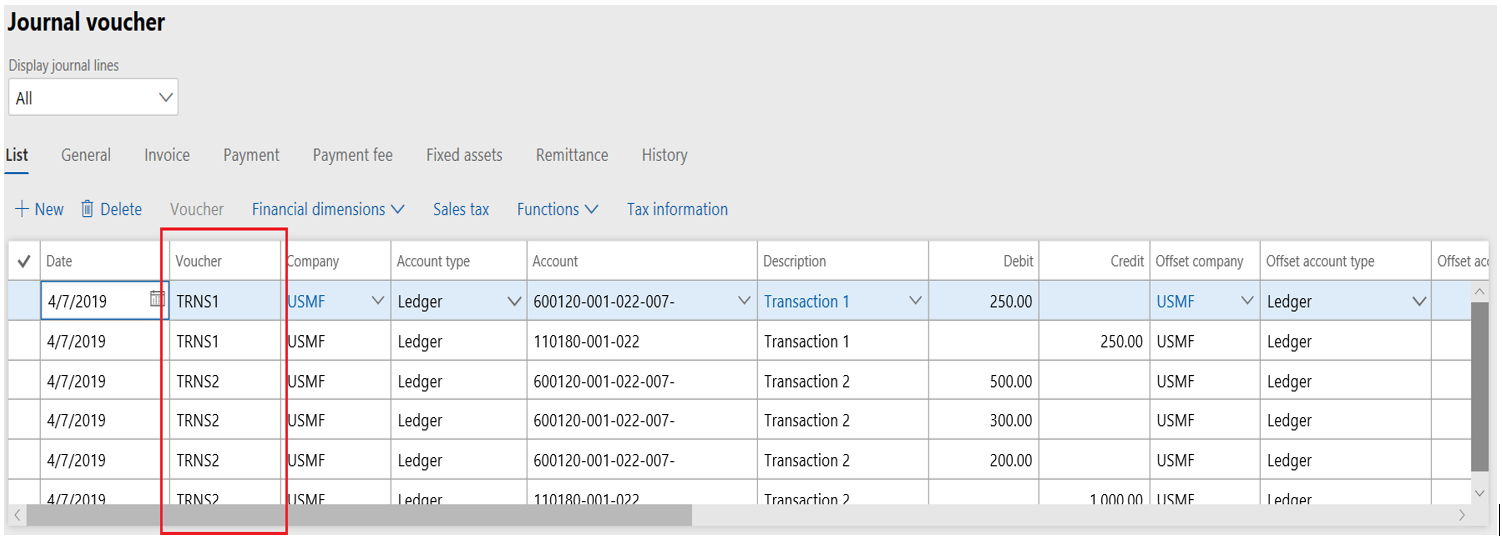

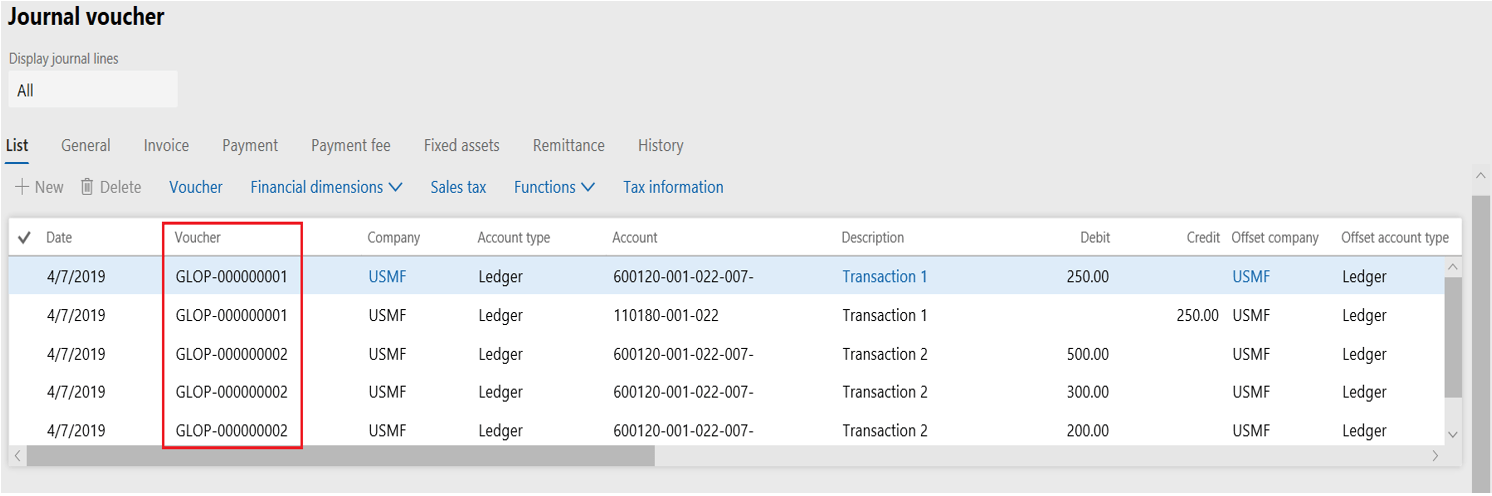

Verify from the below screen that there is error during the import due to incorrect Invoice account from the source data,

Now accounts payable personnel can click on edit and easily rectify the error and create pending vendor invoice directly from this screen. Note the invoice and the default attachment appear side by side on the exception details page

This makes invoice processing much faster by handling all the exceptions on a single list page.

Disclaimer:

This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated. All content provided on this blog is for informational purposes only. This blog makes no representations as to the accuracy or completeness of any information on this site.

Once the data is converted as table, use the table name to specify in MS flow,

Once the data is converted as table, use the table name to specify in MS flow,

Budget Planning Stage rules and Layouts:

Budget Planning Stage rules and Layouts:

Example: Once the Initial budget plan is submitted, AX will automatically change the status of budget plan to ‘CFO review’.

Example: Once the Initial budget plan is submitted, AX will automatically change the status of budget plan to ‘CFO review’.

CFO review: CFO review layout with both previous year actual and Final budget columns.

CFO review: CFO review layout with both previous year actual and Final budget columns. Approved: Final stage with both previous year actual and Final budget columns.

Approved: Final stage with both previous year actual and Final budget columns.